The Intricate Landscape of Carbon Markets: Microstructure, Pricing, and Policy

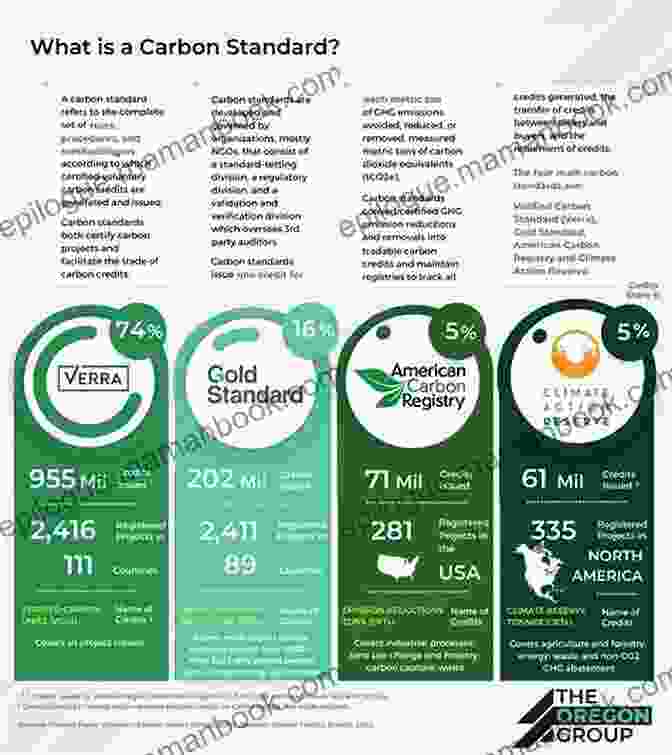

Carbon markets, established as a central component of global efforts to combat climate change, provide a platform for trading carbon credits. These credits represent the right to emit a specified quantity of greenhouse gases (GHGs),typically measured in metric tons of carbon dioxide equivalent (CO2e). By creating a market value for carbon, these markets aim to incentivize emission reductions and shift investment towards sustainable practices.

4.5 out of 5

| Language | : | English |

| File size | : | 3492 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 310 pages |

This article delves into the intricate microstructure, pricing dynamics, and policy frameworks that shape carbon markets. Understanding these aspects is crucial for market participants, policymakers, and stakeholders who seek to harness their potential in addressing the pressing challenge of climate change.

Microstructure of Carbon Markets

The microstructure of carbon markets refers to the underlying mechanisms and institutions that facilitate the trading of carbon credits. It encompasses various elements, including:

Market Participants:

Carbon markets involve a diverse range of participants, from governments and regulatory bodies to companies, investors, and non-governmental organizations (NGOs). Each participant has distinct roles and objectives within the market, contributing to its overall dynamics.

Trading Platforms:

Carbon credits are traded on various platforms, including exchanges, over-the-counter (OTC) markets, and registries. Each platform operates under specific rules and procedures, catering to different market segments and preferences.

Contract Types:

Carbon credits are traded under various contract types, such as spot contracts for immediate delivery, futures contracts for delivery at a specified future date, and options contracts that provide the right to buy or sell credits at a predetermined price.

Market Transparency:

Transparency plays a vital role in carbon markets, ensuring that market participants have access to accurate and timely information about prices, trading volumes, and market sentiment. Transparent markets foster trust and facilitate informed decision-making.

Pricing Dynamics in Carbon Markets

The pricing of carbon credits is a complex and dynamic aspect of carbon markets. It is influenced by a multitude of factors, including:

Supply and Demand:

The equilibrium price in carbon markets is determined by the interaction of supply and demand for carbon credits. Factors affecting supply include emission reduction targets, technological advancements, and crediting mechanisms. Demand is influenced by the need for companies to comply with regulations, voluntary offsetting initiatives, and investment opportunities.

Market Sentiment:

Sentiment plays a significant role in price fluctuations, often driven by news, events, and expectations about future developments. Positive sentiment can lead to increased demand and higher prices, while negative sentiment can have the opposite effect.

Volatility:

Carbon markets are typically characterized by higher volatility than traditional financial markets. This volatility can be attributed to the relatively young and evolving nature of the market, as well as the inherent uncertainties associated with climate change and emission reduction efforts.

Carbon Price Floor and Ceiling:

Some carbon markets incorporate price floors or ceilings to manage price fluctuations and ensure market stability. These measures can influence the investment decisions of market participants and the overall efficiency of the market.

Policy Frameworks for Carbon Markets

Policy frameworks play a crucial role in shaping the design and operation of carbon markets. Key policy considerations include:

Emission Cap-and-Trade Systems:

Cap-and-trade systems establish a mandatory cap on overall emissions and allow participants to trade permits representing the right to emit within that cap. This mechanism creates a tradable currency for carbon emissions and drives innovation towards emission reduction strategies.

Carbon Taxes:

Carbon taxes impose a direct cost on carbon emissions, incentivizing companies to reduce emissions or invest in carbon capture and storage technologies. Taxes can be flat or tiered based on emissions levels and can complement other market-based mechanisms.

Linking and Harmonization:

Linking different carbon markets allows for the trading of credits across borders, enhancing liquidity and fostering collaboration on a global scale. Harmonization efforts aim to reduce regulatory barriers and ensure compatibility between different market frameworks.

Challenges and Opportunities in Carbon Markets

Carbon markets face several challenges, including:

Double Counting:

Double counting occurs when the same emission reductions are credited in multiple markets, leading to overestimation of overall emission reductions. Robust accounting mechanisms and collaboration among market participants are essential to address this challenge.

Additionality:

Additionality refers to the requirement that emission reductions achieved through carbon market mechanisms must be additional to what would have occurred without the market. Establishing clear additionality criteria and monitoring mechanisms is crucial to ensure the integrity of carbon markets.

Market Manipulation:

As carbon markets mature, concerns about market manipulation arise. Regulators must implement surveillance systems and enforcement mechanisms to prevent fraudulent activities that could undermine market confidence.

Despite these challenges, carbon markets offer significant opportunities:

Climate Mitigation:

Carbon markets provide a cost-effective way to reduce GHG emissions by incentivizing emission reductions and driving innovation. They can complement other climate policies, such as renewable energy targets and energy efficiency measures.

Economic Growth:

Carbon markets can foster economic growth by creating new industries and jobs related to emission reduction technologies, carbon sequestration, and sustainable practices. They can also stimulate innovation and competitiveness in low-carbon sectors.

Energy Security:

By promoting the transition to clean energy sources, carbon markets contribute to energy security by reducing dependence on fossil fuels and increasing the resilience of energy systems to climate change impacts.

Carbon markets are a complex and evolving mechanism for addressing the global challenge of climate change. Understanding the microstructure, pricing dynamics, and policy frameworks underpinning these markets is essential for maximizing their potential and mitigating potential risks. Through collaboration among governments, businesses, and civil society, carbon markets can play a pivotal role in creating a more sustainable and low-carbon future.

As the world navigates the transition to a net-zero economy, carbon markets are expected to expand and play an increasingly significant role in the global climate action landscape. Continued refinement of these markets, coupled with robust policy frameworks and international cooperation, will be crucial to unlocking their full potential in the fight against climate change.

4.5 out of 5

| Language | : | English |

| File size | : | 3492 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 310 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Diane Campbell Green

Diane Campbell Green Jack Frost

Jack Frost Miles Cameron

Miles Cameron Ashley Rescot

Ashley Rescot Harvey Stanbrough

Harvey Stanbrough Dianne Duvall

Dianne Duvall David E Hoffman

David E Hoffman Gladstone D Meyler

Gladstone D Meyler Noga Arikha

Noga Arikha Readlist

Readlist Shameek Speight

Shameek Speight Julian Lincoln Simon

Julian Lincoln Simon Oliver Sacks

Oliver Sacks Mark Ramsay

Mark Ramsay Saifedean Ammous

Saifedean Ammous Maryrose Wood

Maryrose Wood Lorraine Blundell

Lorraine Blundell Chaitanya Yechuri

Chaitanya Yechuri Conor Dougherty

Conor Dougherty Susan Stoker

Susan Stoker

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

John Dos PassosFollow ·14.7k

John Dos PassosFollow ·14.7k Jamie BellFollow ·19.6k

Jamie BellFollow ·19.6k Colton CarterFollow ·10.8k

Colton CarterFollow ·10.8k Jamal BlairFollow ·9.8k

Jamal BlairFollow ·9.8k Easton PowellFollow ·10.7k

Easton PowellFollow ·10.7k Darren NelsonFollow ·11.5k

Darren NelsonFollow ·11.5k Dalton FosterFollow ·19.6k

Dalton FosterFollow ·19.6k Stanley BellFollow ·18.5k

Stanley BellFollow ·18.5k

Cole Powell

Cole PowellThe Baby First Guide to Stress-Free Weaning: Healthy...

Weaning your baby is a significant...

Drew Bell

Drew BellBumble Boogie: An Infectious Swing Classic by Freddy...

||| | |||||| : In the annals of American...

Albert Reed

Albert ReedKnitting Pattern Kp336 Baby Garter Stitch Cardigan 3mths...

Overview This knitting pattern is for a...

Mark Mitchell

Mark MitchellThe Brand New Laugh-Out-Loud Novel From Shari Low: A...

Get ready to embark on a...

Leo Tolstoy

Leo TolstoyThe Original 1674 Epic Poem Student Edition Annotated: An...

John Milton's Paradise...

4.5 out of 5

| Language | : | English |

| File size | : | 3492 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 310 pages |