The Housing Crisis and the Reckoning for the American Dream: A Comprehensive Examination

The housing crisis that erupted in the United States in 2008 was the most severe financial crisis since the Great Depression. It led to the collapse of the housing market, a wave of foreclosures, and a deep recession. The crisis had a profound impact on the American Dream, which has long been tied to homeownership.

4.6 out of 5

| Language | : | English |

| File size | : | 2263 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 285 pages |

This article provides a comprehensive examination of the housing crisis, exploring its causes, consequences, and implications for the American Dream. We will discuss the role of subprime lending, predatory lending, economic inequality, and financial deregulation in the lead-up to the crisis. We will also examine the impact of the crisis on homeowners, communities, and the national economy.

Causes of the Housing Crisis

The housing crisis was caused by a complex set of factors, including:

- Subprime lending: Subprime loans are loans made to borrowers with poor credit histories and low credit scores. These loans typically have higher interest rates and fees than prime loans, and they are often made with little or no documentation of the borrower's income or assets.

- Predatory lending: Predatory lending is a type of lending that involves unfair or deceptive practices. Predatory lenders often target low-income and minority borrowers, and they may use high-pressure sales tactics to convince borrowers to take out loans that they cannot afford.

- Economic inequality: Economic inequality is the uneven distribution of income and wealth in a society. In the years leading up to the housing crisis, economic inequality in the United States had been growing, and this contributed to the demand for subprime and predatory loans.

- Financial deregulation: Financial deregulation is the reduction or elimination of government regulations on the financial industry. In the 1990s, the U.S. government deregulated the financial industry, and this led to a loosening of lending standards and an increase in risky lending practices.

Consequences of the Housing Crisis

The housing crisis had a devastating impact on the United States, including:

- Foreclosures: The housing crisis led to a wave of foreclosures, as subprime and predatory borrowers defaulted on their loans. In 2009, there were over 1 million foreclosures in the United States.

- Homelessness: The foreclosure crisis led to a surge in homelessness, as many people who lost their homes were unable to find affordable housing.

- Economic recession: The housing crisis triggered a deep recession in the United States. The recession began in December 2007 and lasted until June 2009. During the recession, the U.S. economy lost over 8 million jobs.

Implications for the American Dream

The housing crisis had a profound impact on the American Dream. For many Americans, homeownership is a key part of the American Dream. However, the housing crisis made homeownership less affordable and less attainable for many people.

The housing crisis also challenged the idea that homeownership is a good investment. In the years leading up to the crisis, home prices had been rising rapidly, and many people had purchased homes as investments. However, the housing crisis led to a collapse in home prices, and many people lost their savings.

The Road to Recovery

The United States has been slow to recover from the housing crisis. The foreclosure crisis is ongoing, and many people are still struggling to find affordable housing. The economic recovery has been slow, and many people have lost their jobs or seen their wages decline.

There is no easy solution to the housing crisis. However, there are a number of things that can be done to help people recover from the crisis and to prevent a similar crisis in the future.

These include:

- Strengthening lending standards: The government can strengthen lending standards to make it more difficult for people to qualify for subprime and predatory loans.

- Providing more affordable housing: The government can provide more affordable housing by increasing funding for housing programs and by encouraging the development of affordable housing.

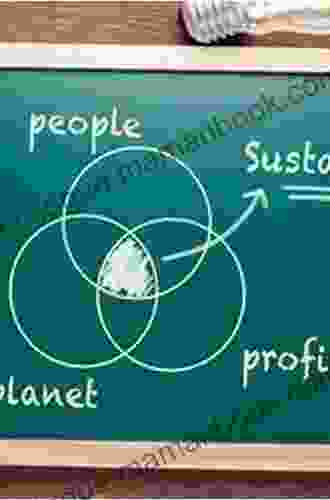

- Promoting economic equality: The government can promote economic equality by raising the minimum wage, increasing access to education and job training, and providing tax breaks for low-income families.

- Regulating the financial industry: The government can regulate the financial industry to prevent risky lending practices and to protect consumers from predatory lending.

The housing crisis was a complex and devastating event that had a profound impact on the United States. The crisis challenged the American Dream of homeownership and led to a deep recession. However, there is hope for recovery. By taking steps to strengthen lending standards, provide more affordable housing, promote economic equality, and regulate the financial industry, we can help people recover from the housing crisis and prevent a similar crisis in the future.

4.6 out of 5

| Language | : | English |

| File size | : | 2263 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 285 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Oliver Sacks

Oliver Sacks Julie Anne Lindsey

Julie Anne Lindsey Sky Gilbert

Sky Gilbert Rosecrans Baldwin

Rosecrans Baldwin Harvey Stanbrough

Harvey Stanbrough A G Riddle

A G Riddle Becki Cohn Vargas

Becki Cohn Vargas Annabel Wrigley

Annabel Wrigley Rik Degunther

Rik Degunther Karen Basulto

Karen Basulto Daniel Lacalle

Daniel Lacalle Joanna Dolgoff

Joanna Dolgoff Miguel A Labrador

Miguel A Labrador Mark A Noll

Mark A Noll Johnny D Boggs

Johnny D Boggs Roxanne St Claire

Roxanne St Claire Readlist

Readlist J D Brink

J D Brink Minka Kent

Minka Kent Dave Brown

Dave Brown

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Pete BlairFollow ·17.1k

Pete BlairFollow ·17.1k Arthur MasonFollow ·19.6k

Arthur MasonFollow ·19.6k Aaron BrooksFollow ·6.6k

Aaron BrooksFollow ·6.6k Dylan HayesFollow ·8.1k

Dylan HayesFollow ·8.1k Samuel BeckettFollow ·11.7k

Samuel BeckettFollow ·11.7k Michael SimmonsFollow ·12.9k

Michael SimmonsFollow ·12.9k Jessie CoxFollow ·19.9k

Jessie CoxFollow ·19.9k Kevin TurnerFollow ·7.7k

Kevin TurnerFollow ·7.7k

Cole Powell

Cole PowellThe Baby First Guide to Stress-Free Weaning: Healthy...

Weaning your baby is a significant...

Drew Bell

Drew BellBumble Boogie: An Infectious Swing Classic by Freddy...

||| | |||||| : In the annals of American...

Albert Reed

Albert ReedKnitting Pattern Kp336 Baby Garter Stitch Cardigan 3mths...

Overview This knitting pattern is for a...

Mark Mitchell

Mark MitchellThe Brand New Laugh-Out-Loud Novel From Shari Low: A...

Get ready to embark on a...

Leo Tolstoy

Leo TolstoyThe Original 1674 Epic Poem Student Edition Annotated: An...

John Milton's Paradise...

4.6 out of 5

| Language | : | English |

| File size | : | 2263 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 285 pages |